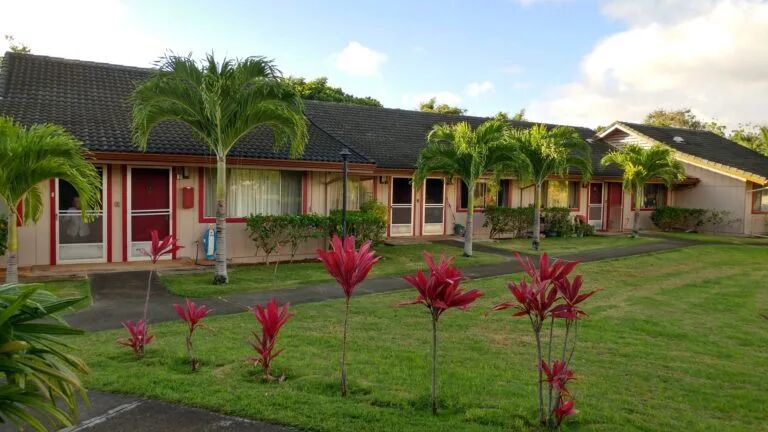

Lihue Gardens, a 57-unit affordable housing property in Hawaii's competitive housing market, presented a unique opportunity to maximize rental income through strategic Mark Up to Market restructuring. Despite favorable market conditions and significant untapped rental potential, previous Rent Comparability Studies (RCS) had undervalued the property's true market position.

Property Overview

| Location | Lihue, Kauai, Hawaii |

| Units | 57 |

| Market Type | Hawaii Affordable Housing |

| Initial Monthly Rents (2025) | $1,928 |

| Approved Monthly Rents | $2,450 |

The Challenge

Lihue Gardens, like many affordable housing properties, faced a critical sustainability challenge. Previous Rent Comparability Studies had significantly undervalued the property's rental potential, leaving the owner without adequate income to address aging building systems and accumulating deferred maintenance. At only $1,928 per month in 2025—well below market rates—the property couldn't generate sufficient reserves for the capital improvements necessary to preserve this affordable housing resource for Kauai's community.

Without enhanced cash flow, the property risked continued deterioration, making future comprehensive rehabilitation increasingly difficult and expensive. The owner needed market-appropriate rents not just for investment returns, but to secure the resources essential for preserving this 57-unit affordable housing property for the low-income families who depend on it.

Our Approach

Cornerstone Advisory Group conducted an independent, comprehensive Rent Comparability Study focused on identifying truly comparable properties in the Hawaii market. Rather than accepting the limitations of previous studies, we:

- Performed exhaustive market research to identify appropriate comparables that previous studies had overlooked

- Developed detailed justifications for each comparable property selected, demonstrating their relevance to Lihue Gardens

- Built a compelling case supported by market data and HUD compliance requirements

- Navigated the HUD approval process to secure rent levels that accurately reflected market conditions

This rigorous approach ensured that the approved rents were both defensible and optimal for the property owner.

Results

* 223(f) value calculated using 80% LTV, 1.15 DSCR, 35-year full amortization at 5.25% interest rate. Cap rate value based on direct capitalization at 5%. GPR reflects 5% property management fee on GPR increase. The rent increase requires no additional operational costs beyond standard management fees.

The Impact: Preserving Affordable Housing for Kauai

Cornerstone Advisory Group successfully secured HUD approval for monthly rents of $2,450—a $522 increase per unit that delivers over $357,000 in additional annual gross potential rent. After accounting for a standard 5% property management fee, this provides approximately $339,000 in additional annual Gross Potential Rent.

This income increase isn't just about financial returns—it's about preservation. The additional $339,000 in annual GPR provides the owner with critical resources to:

- Address deferred maintenance and aging building systems that threaten property viability

- Build capital reserves for major systems replacements (roof, HVAC, plumbing) necessary to extend building life

- Position for future LIHTC applications that could fund comprehensive rehabilitation, preserving these 57 affordable units for another 30-40 years

- Maintain quality housing for low-income families on Kauai, where affordable housing is critically scarce

Without this income optimization, the property would continue deteriorating with inadequate reserves, ultimately risking conversion to market-rate housing or sale—resulting in the loss of 57 affordable units from Kauai's housing stock. This project preserved vital affordable housing for the community while creating sustainable financial foundations for long-term operation.

Property Value Impact

The GPR increase also translates to substantial property value through two standard valuation approaches—providing the owner with flexibility for recapitalization through refinancing or future sale:

HUD 223(f) Loan Basis

$5,900,466

Based on 80% LTV cash-out refinance with 1.15 DSCR at 5.25% interest, 35-year full amortization

Direct Cap Rate Basis

$6,784,360

Based on direct capitalization at 5% cap rate, reflecting strong market fundamentals

Long-Term Impact Analysis

To demonstrate the sustained value of this rent increase, we analyzed a conservative growth scenario assuming only 3% annual rent increases from the initial $1,928 baseline. The table below shows how many years it would take to reach the approved $2,450 rent level through gradual increases alone:

| Year | Conservative Rent (3% Growth) | Approved Rent (3% Growth) | Annual Advantage |

|---|---|---|---|

| 2025 (Starting) | $1,928 | $2,450 | $522 |

| 2026 | $1,986 | $2,524 | $538 |

| 2027 | $2,045 | $2,599 | $554 |

| 2028 | $2,107 | $2,677 | $570 |

| 2029 | $2,170 | $2,757 | $587 |

| 2030 | $2,235 | $2,840 | $605 |

| 2031 | $2,302 | $2,925 | $623 |

| 2032 | $2,371 | $3,013 | $642 |

| 2033 | $2,442 | $3,103 | $661 |

| 2034 | $2,515 | $3,196 | $681 |

Key Takeaway: The approved rent increase provides immediate value equivalent to 8-9 years of 3% annual growth—adding $5.9M to $6.8M in property value through a single strategic Mark Up to Market restructuring. Moreover, the advantage compounds over time, with the monthly per-unit difference growing from $522 to $681 over the 10-year period shown.

Owner Benefit: The $357,072 annual GPR increase delivers approximately $339,218 in additional Gross Potential Rent after accounting for a standard 5% property management fee. HUD Mark Up to Market contracts require no additional operational costs beyond management fees, ensuring maximum value capture for property owners.